RETAIL WEALTH CONCEPT

CIBC • January - June 2024

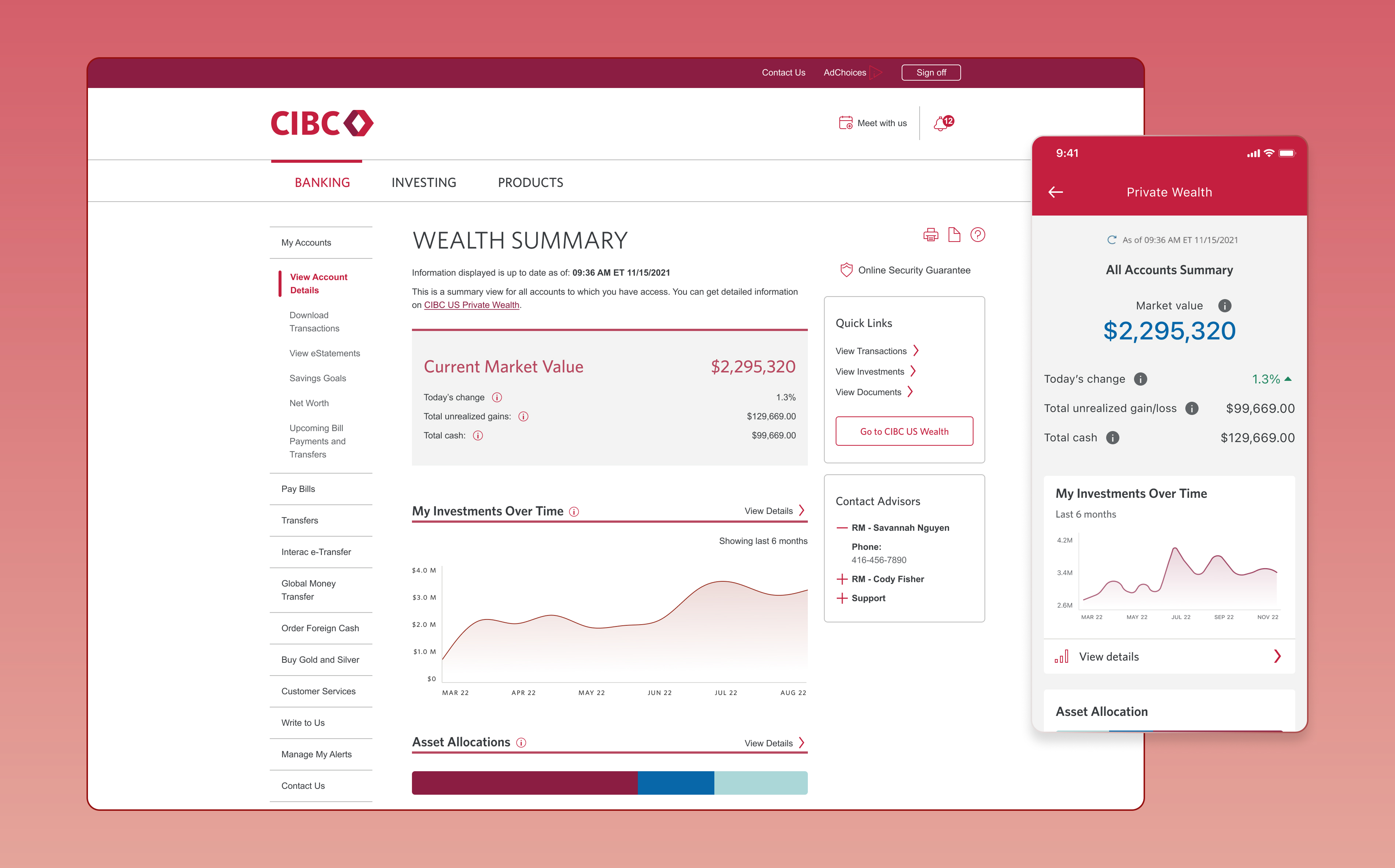

Elevating a wealth experience with expected banking features

PROJECT CONTEXT

CIBC was acquiring a US retail bank in late 2022 and needed to explore integration opportunities with their existing wealth management business. The challenge, leverage the new retail platform to better serve high-net-worth clients without compromising their premium experience.

As the Product Designer on the Enterprise Digital Strategy team, I led the design exploration to bridge wealth management and everyday banking services through strategic research and cross-functional collaboration.

PROJECT FEATURES

Mobile Application

Product Design

Feature Concept

Understanding wealth client needs and behaviors

Research Approach

Our discovery included interviews with both high-net-worth clients and their relationship managers to understand user needs, behaviors, and pain points from multiple perspectives.

INSIGHTS

Advisory relationships drives usage

Clients prefer digital monitoring while relying on advisors for strategic decisions, emphasizing enhancement over replacement of human relationships.

Multi-generational usage patterns

Brand trust concerns

Design Approach

Problem Framing

Research revealed three core design tensions:

Integration vs. Distinction

How might we integrate retail banking features without diluting the premium wealth experience?

Simplicity vs. Capability

How might we prioritize monitoring needs while maintaining access to complex wealth tools?

Universal vs. Personal needs

How might we serve multi-generational users without creating a lowest-common-denominator experience?

PRINCIPLE

I established an Advisory First principle, every feature strengthens rather than replaces human relationships, guiding all design decisions toward collaboration over self-service.

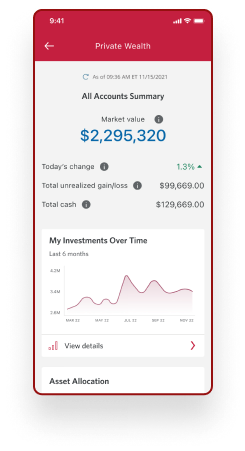

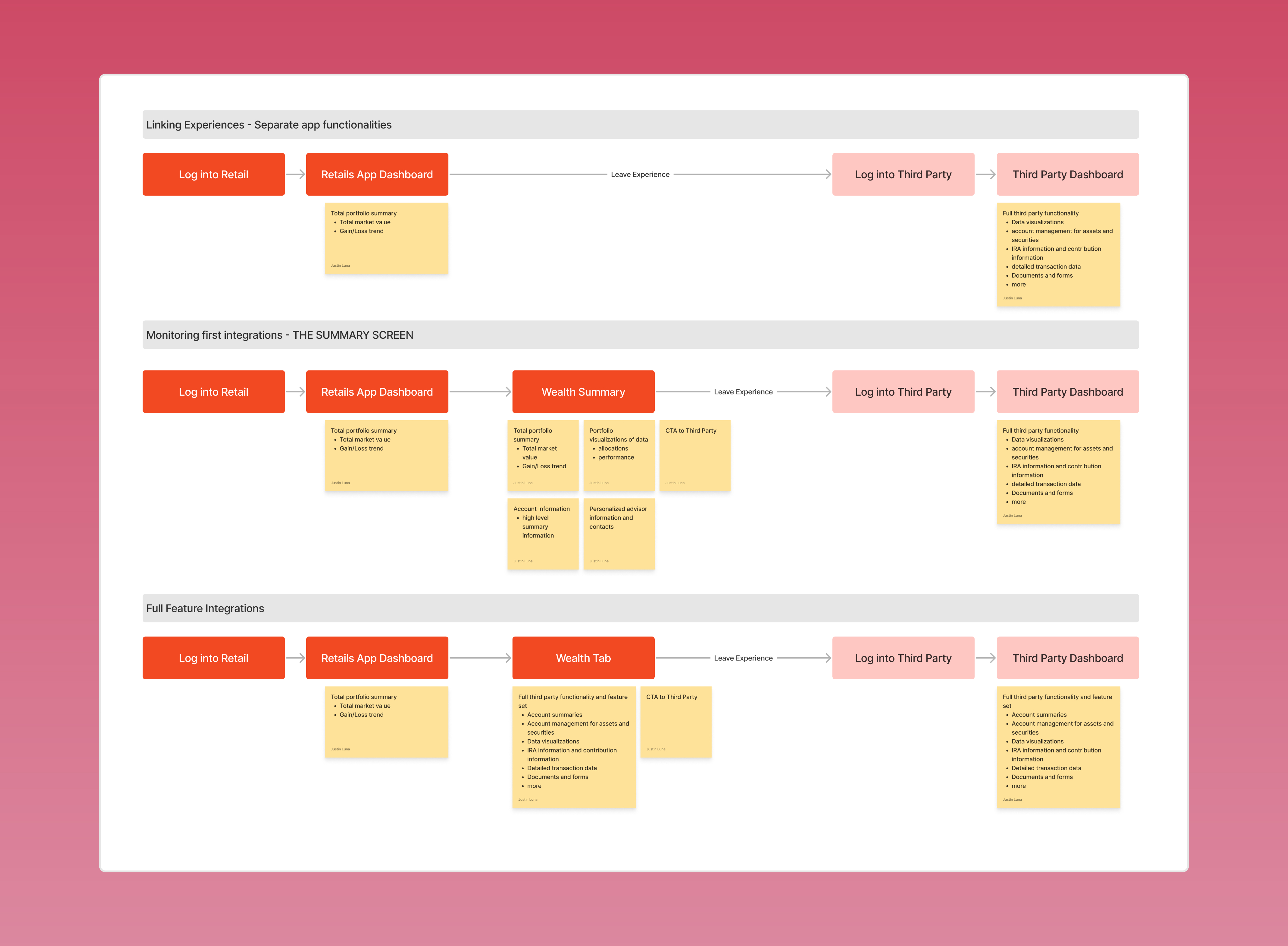

Explorations

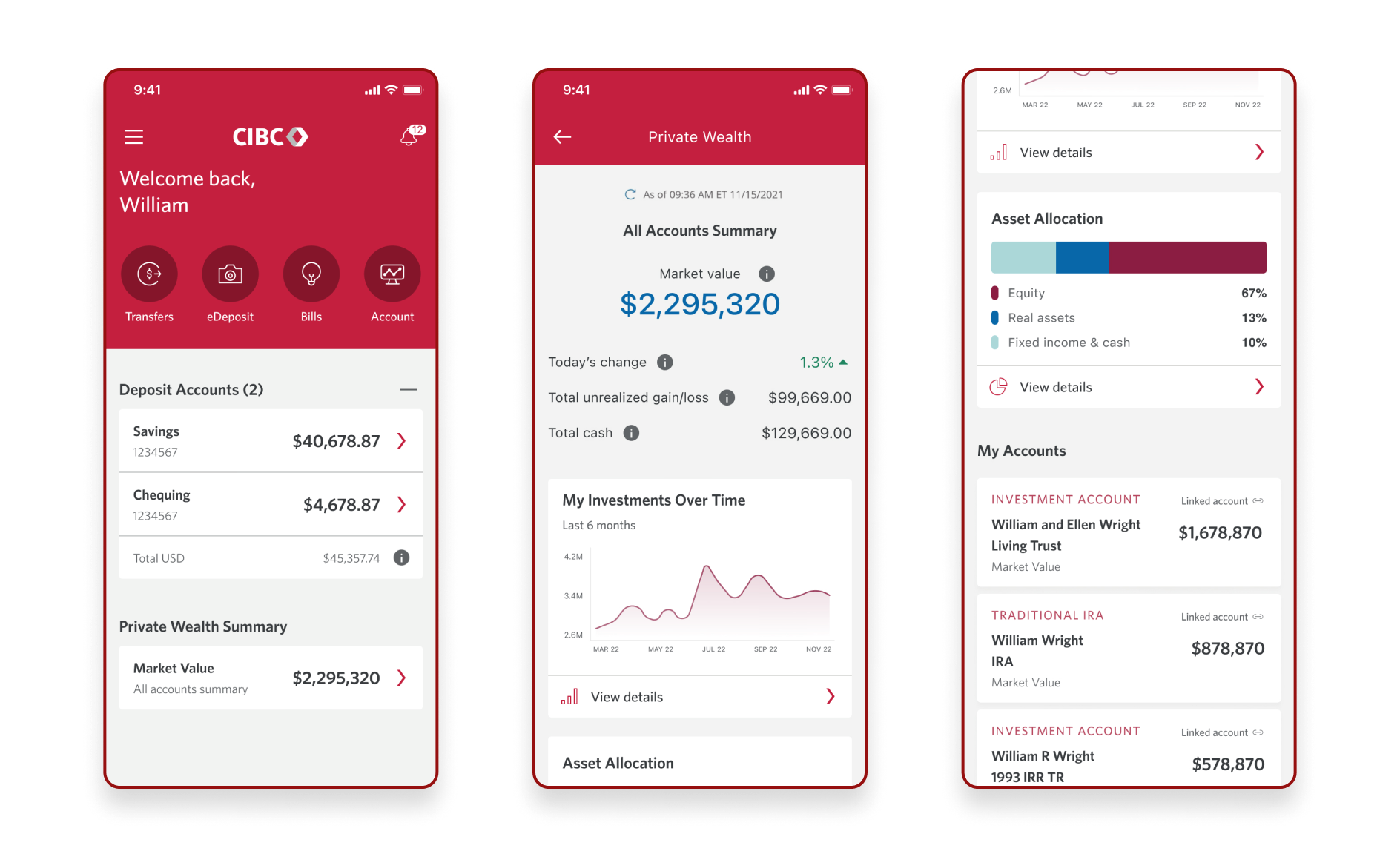

I explored full integration and separate app approaches before selecting monitoring-first integration as the optimal balance of user needs and business objectives. This approach preserves the premium wealth experience while delivering consolidated access to essential banking features.

Key constraint: Six-month timeline required focusing on highest-impact features that could adapt to changing acquisition requirements.

[IMAGE: Simple comparison table or framework showing the three approaches considered]

Designing a monitoring-first wealth experience

Our Solution

Research revealed that across all generations, users preferred digital platforms primarily for portfolio monitoring while relying on advisors for active management. This insight shaped our design strategy: rather than replicating complex self-service features, we focused on creating an intuitive monitoring experience that delivers immediate value while preserving access to comprehensive wealth management tools.

Design Challenge

Create an integrated platform that strengthens advisory relationships while delivering the consolidated, CIBC-branded experience clients wanted. This meant thoughtfully combining retail banking capabilities with wealth insights in a way that feels natural and valuable across all user generations.

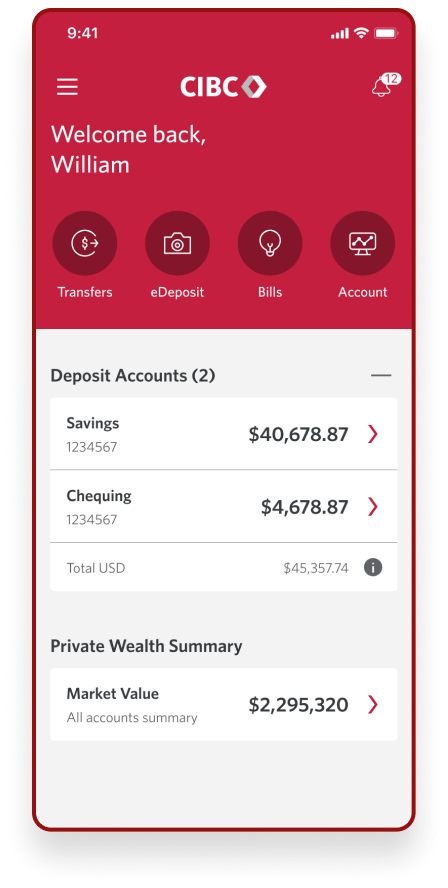

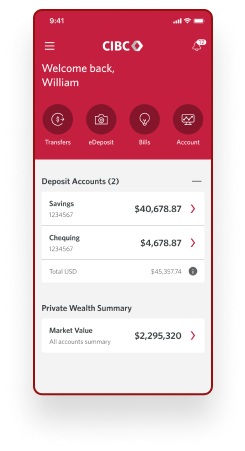

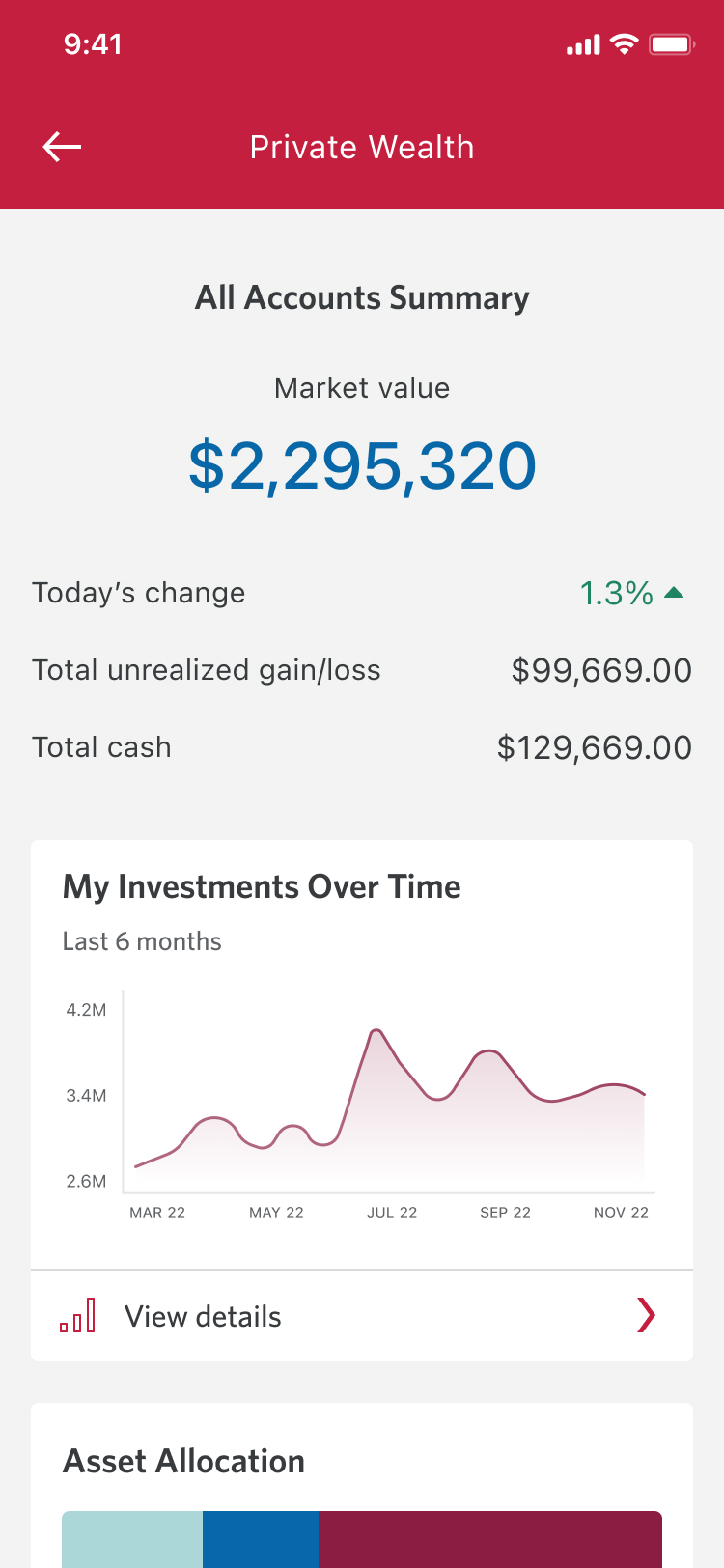

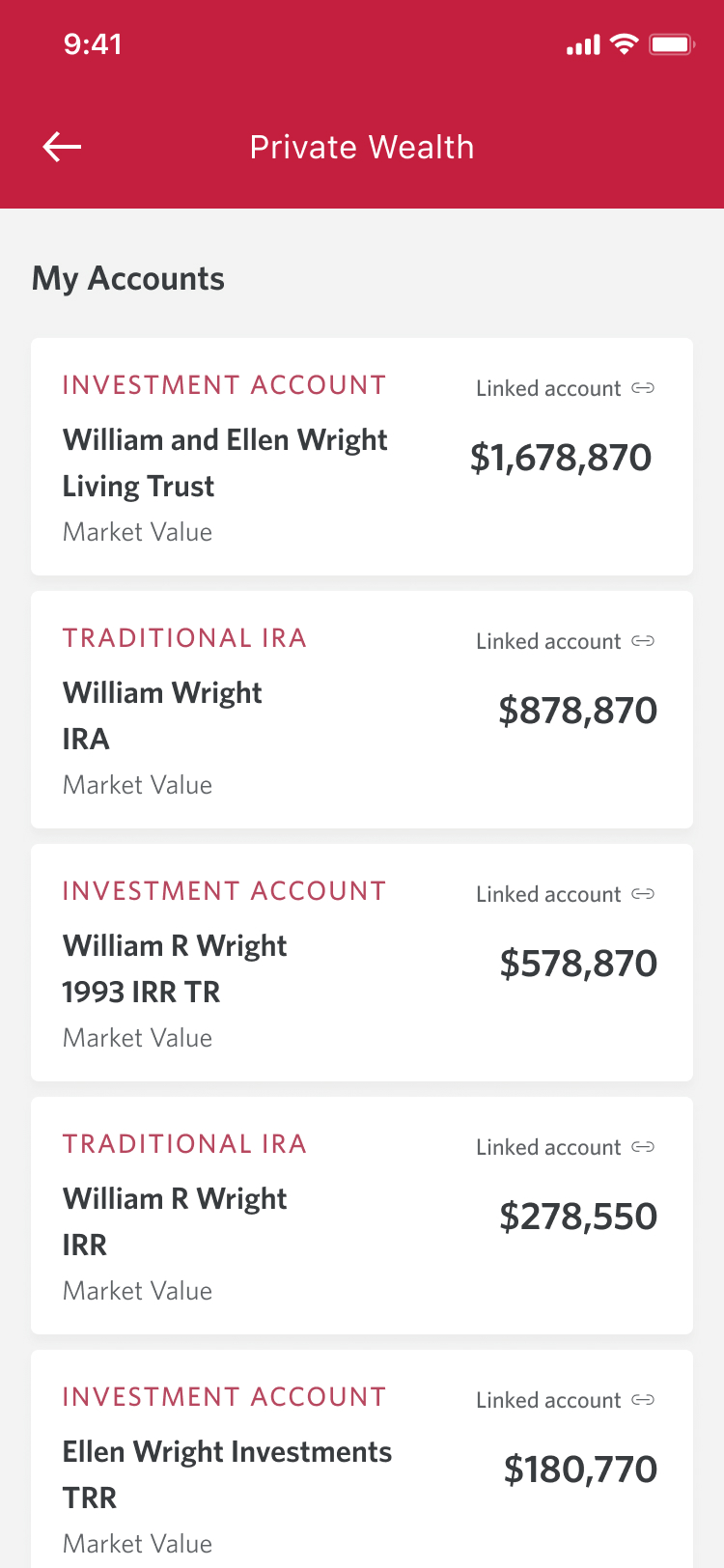

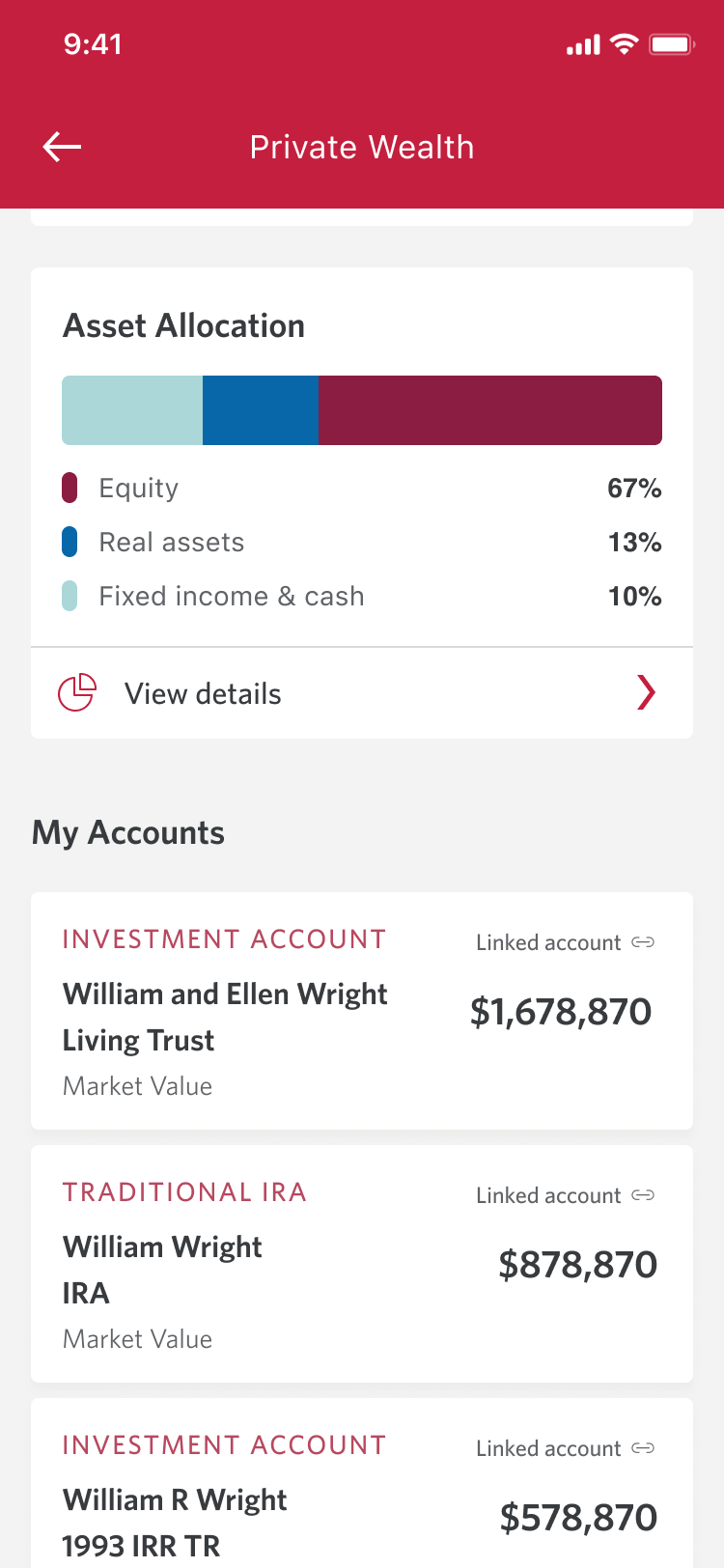

Account and Portfolio Summaries

At-a-glance monitoring designed for quick health checks:

- Portfolio snapshots High-level performance indicators and asset allocation summaries

- Account balancesReal-time view of cash positions and recent activity across all accounts

These summaries serve as a dashboard for busy clients, enabling quick status checks while seamlessly directing them to detailed analysis tools or their relationship manager when deeper engagement is needed.

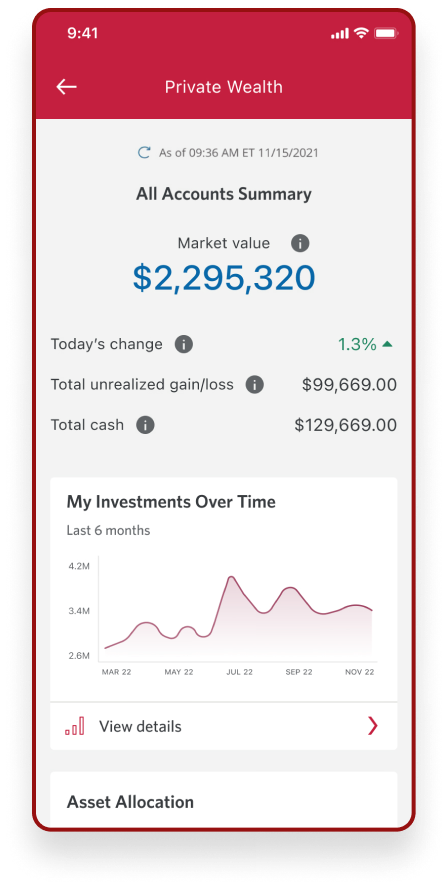

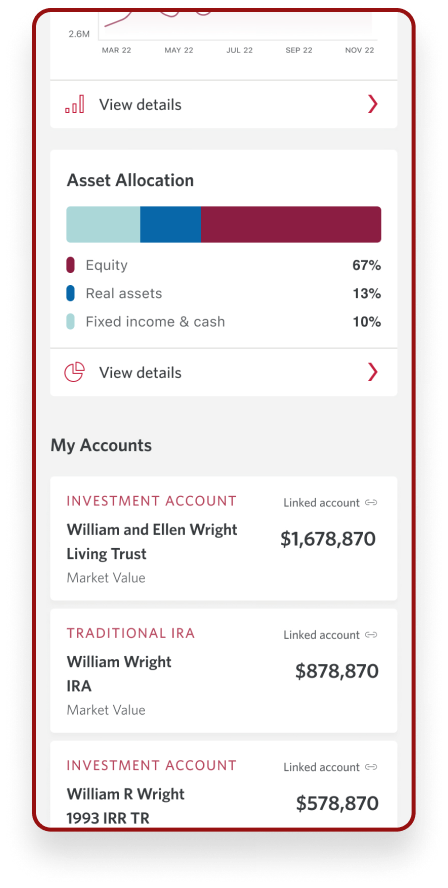

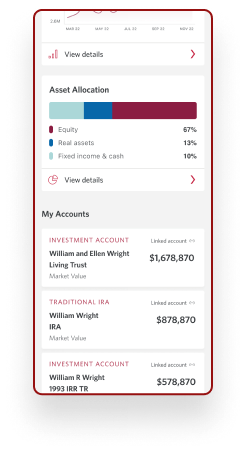

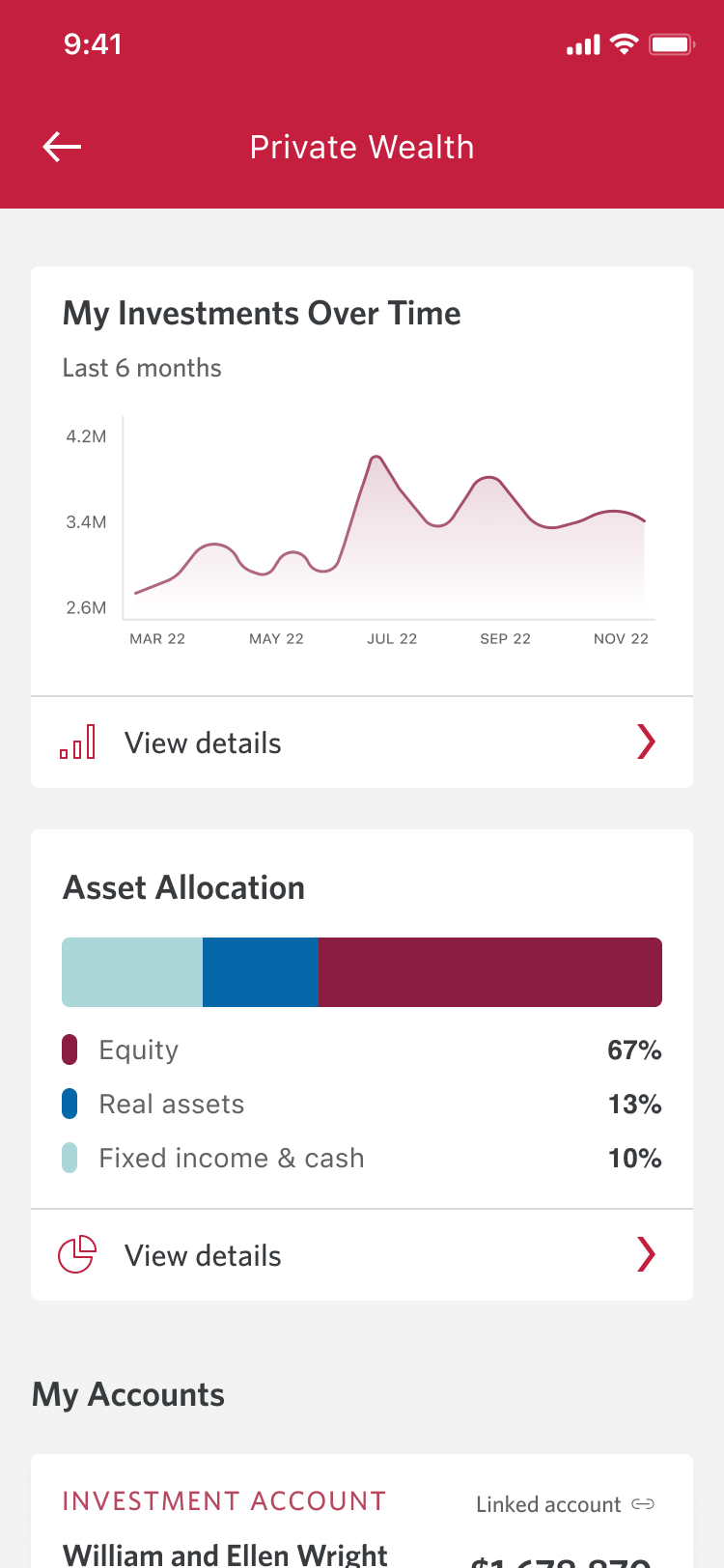

Performance and allocation visualizations

Clear visual insights for informed portfolio monitoring:

- Performance trackingInteractive charts showing investment growth over customizable time periods.

- Asset allocation breakdownVisual representation of portfolio distribution across equity, real assets, and fixed income

- Trend analysisHistorical performance data to identify patterns and market impact on holdings

These visualizations transform complex financial data into digestible insights, empowering clients to quickly assess portfolio health and make informed decisions about when to engage their advisors for strategic adjustments.

Personalized and quick access support

Seamless connection to dedicated wealth management professionals:

- Your team directoryInstant access to assigned account managers and relationship managers

- One-tap contactDirect calling, messaging, and meeting scheduling with your dedicated advisors

- Personalized profilesClear identification of each team member's role and expertise areas

This feature reinforces the advisory-first approach our research validated, ensuring clients can immediately connect with their trusted professionals when monitoring reveals questions or opportunities requiring expert guidance.

Project Outcomes

Our solution received enthusiastic stakeholder approval and secured funding for initial release. However, external business factors, specifically an unsuccessful bank acquisition, led to the project being shelved. While disappointing, this experience provided valuable insights into the complex relationship between product design and broader business strategy in enterprise environments.

Learnings

Balancing speed with depth

Our rapid research and prototyping approach successfully validated concepts and secured stakeholder buy-in quickly. This experience reinforced the value of moving fast in uncertain business environments, though additional user testing could have further strengthened our solution.

Design systems enable focus

Clear communication builds resilience